open end mortgage vs heloc

A second mortgage and a home equity line of credit HELOC both use your home as collateral. Choose an open-ended loan when you require a constantly available line of credit for ongoing expenses.

Find The Best HELOC Mortgage Rates.

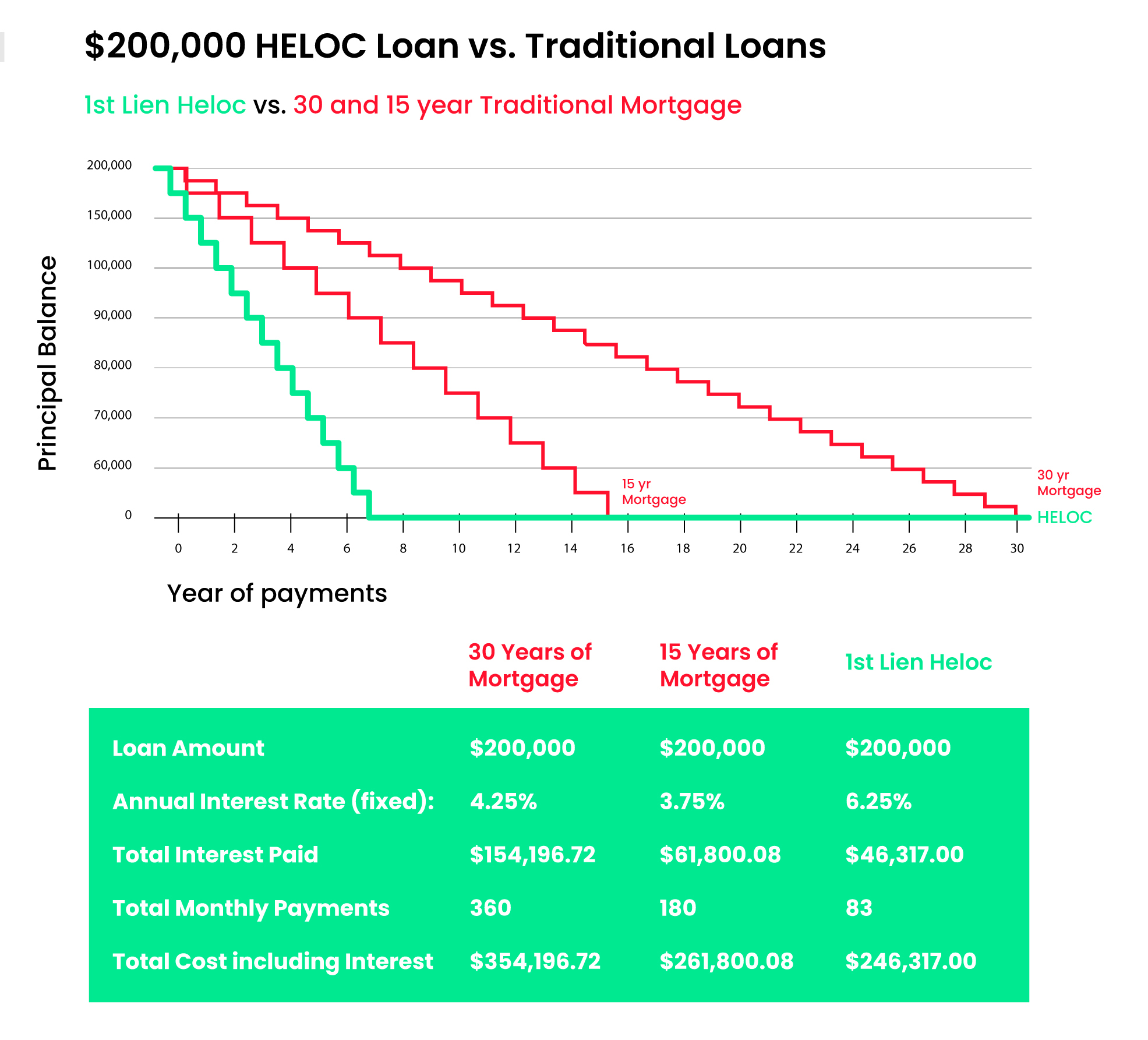

. Now lets look at using a First Lien HELOC and the strategy used to reduce your interest cost. Unlike a mortgage both open- and closed-ended home equity loans are low-fee transactions. Just like other mortgages HELOCs have costs and.

An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit. In effect you can. Open-end credit is not restricted to a specific.

Using our previous example of a 200000 loan at the same. An open-ended loan is priced at a floating interest rate. Special Offers Just a Click Away.

Pay for college tuition with an open-ended loan or for long-term medical care. Like a credit card a. It remains open and it.

When you take out a HELOC you receive a maximum line of credit that you may access. An open-end mortgage is a type of home loan in which the total amount of the loan is not advanced all at once but rather used for future home-related improvements as. You can use the equity in your home to pay for.

A second mortgage is paid out in one lump sum at the beginning. An open-end mortgage is also sometimes called a home improvement loan. Its kind of like a mortgage and home equity line of credit HELOC rolled into one loan when a.

This means that the rate can change when the index changes. A home equity line of credit HELOC is an open-end line of credit that allows you to borrow repeatedly against your home equity. A HELOC works a bit like a credit card in that you have a pre-approved limit can borrow at your own pace and repay the outstanding balance as you go.

Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time. For example if your loan is priced at prime plus 1 percent with prime being. On July 13 2022 Nasdaq reported that the average interest rate for a 10-year HELOC was at a 52-week high of 551 and a 52-week low of 255 percent.

If the terms open end loan and open end mortgage mean the same thing as described in Section 10262a20 then preceding comments apply. Unlike other mortgages the HELOC functions like a credit card. 1st Lien HELOC.

An open-end mortgage is a type of loan that allocates enough funds for a home purchase then allows you to draw more as needed to improve the property. A HELOC is a type of second mortgage that allows you to borrow money against the equity in your home as a line of credit.

What Is An Open End Mortgage Rocket Mortgage

What Is An Open End Mortgage The Real Estate Decision

Open End Mortgage Loan What Is It And How It Works

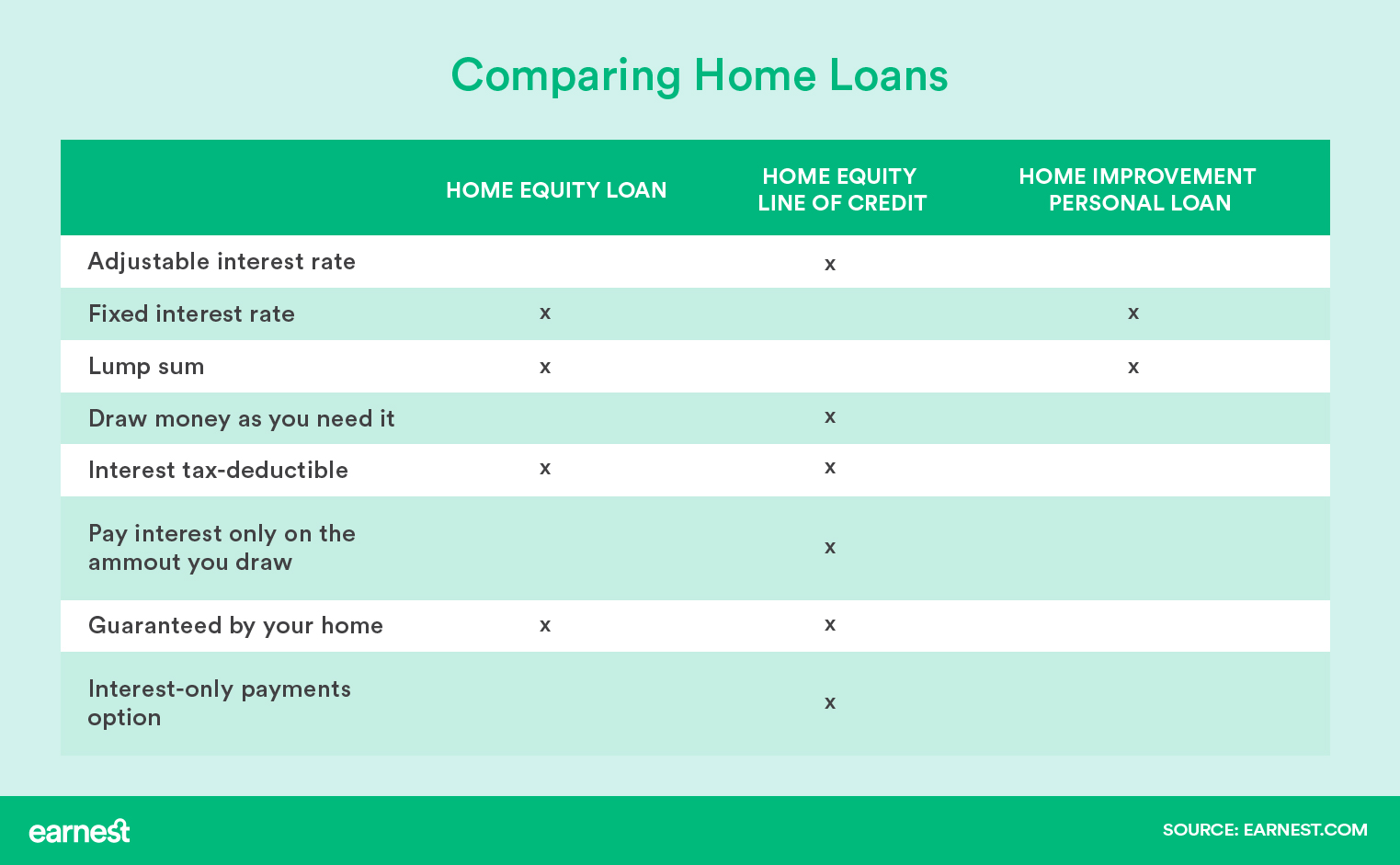

Home Equity Loan Vs Line Of Credit Vs Home Improvement Loan Earnest

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Home Equity Loan Vs Home Equity Line Of Credit Heloc

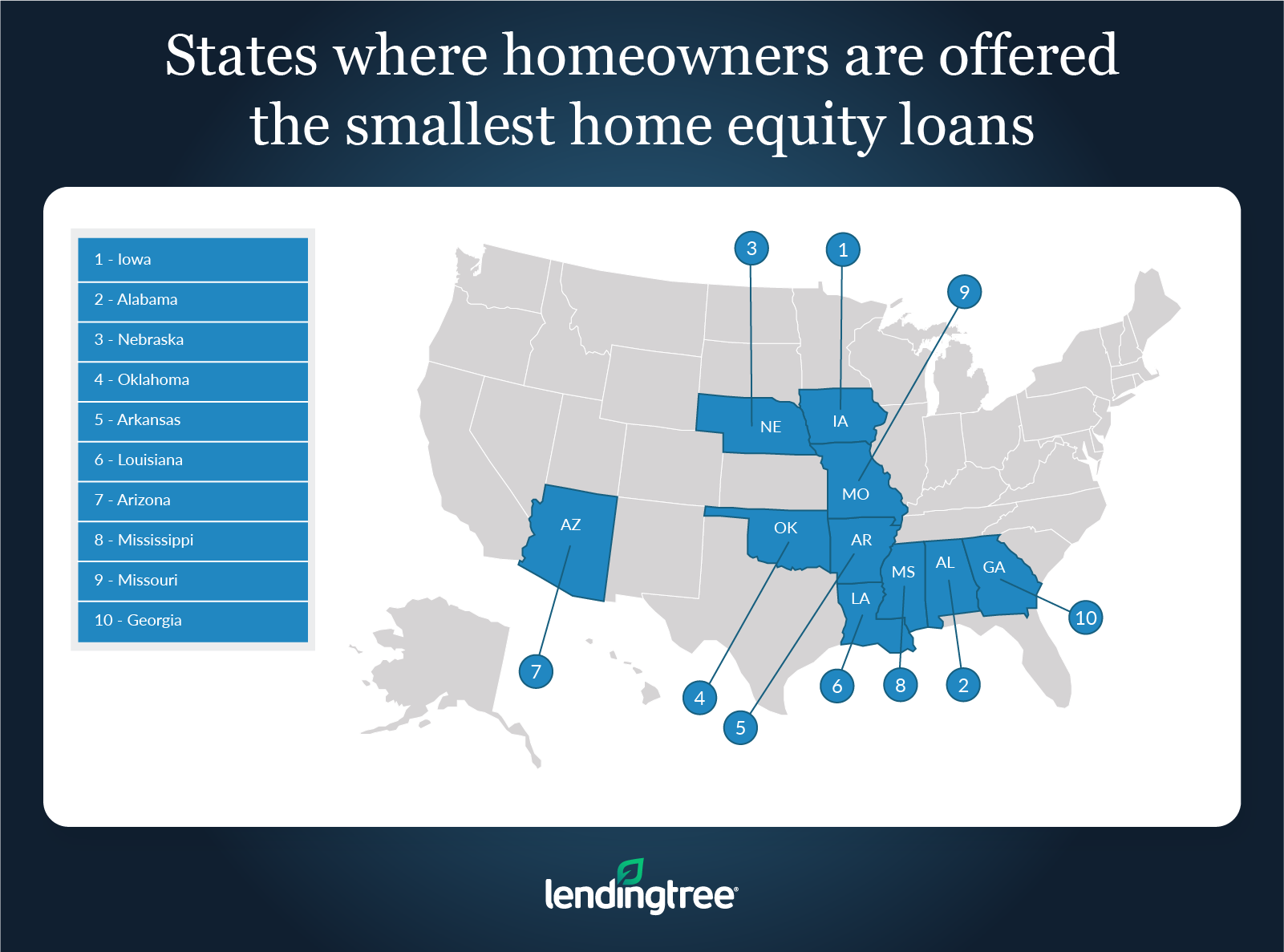

Study Largest Smallest Home Equity Loans Lendingtree

Home Equity Line Of Credit In Hawaii Apply Today American Savings Bank Hawaii

How A Heloc Works Tap Your Home Equity For Cash

Home Equity Loan Versus Heloc Here S How To Decide

Debunking The Mortgage Accelerator Program The Wall Street Physician

6 Home Equity Loan Questions Lenders Must Answer Before Offering Home Equity Products National Mortgage News

15 Home Equity Line Of Credit Heloc Plains Commerce Bank

When To Choose A Heloc To Access Home Equity Benchmark Fcu

Heloc V Renovation Loans What Every Lender Needs To Know Land Gorilla

:max_bytes(150000):strip_icc()/GettyImages-1139792625-92a64bdd532d4018a0a00eaf76f112b6.jpg)

:max_bytes(150000):strip_icc()/shutterstock_532025803.mortgage.insurance.cropped-5bfc314046e0fb00265cf926.jpg)